FOUNDER'S GUIDE

TO UAE CRYPTO LAWS

2026 Edition

Your Legal Blueprint to Launch, Scale, and Stay Compliant in the World’s Fastest Growing Web3 Hub

*Instant PDF access. No spam, ever.

Introduction to the UAE – The Ideal Base for Crypto Founders

The United Arab Emirates has emerged as one of the world’s most attractive jurisdictions for crypto and Web3 founders and their ventures. Combining political and economic stability, a 0% personal income tax, and 9% corporate tax, the UAE delivers a rare blend of innovation and legal certainty. Business-friendly policies, strategic geographic positioning, and a regulatory landscape tailored for digital asset growth make it a preferred destination for ambitious entrepreneurs and investors.

Founders benefit from full foreign ownership rights, no capital controls, fast company formation, world-class infrastructure and access to services. The UAE also offers fast-track residency pathways, such as the 10-year Golden Visa, for startup founders, investors, and highly skilled professionals.

There are well-defined regulations covering everything from VASP licensing, such as crypto exchanges and custodians, to token issuance and RWA tokenization, as well as DAO formation and DevCos for DeFi and Layer1 projects.

Authors

Share

Over 3,500 Founders and Investors Have This on Their Desk. Do You?

Establishing UAE Crypto Company

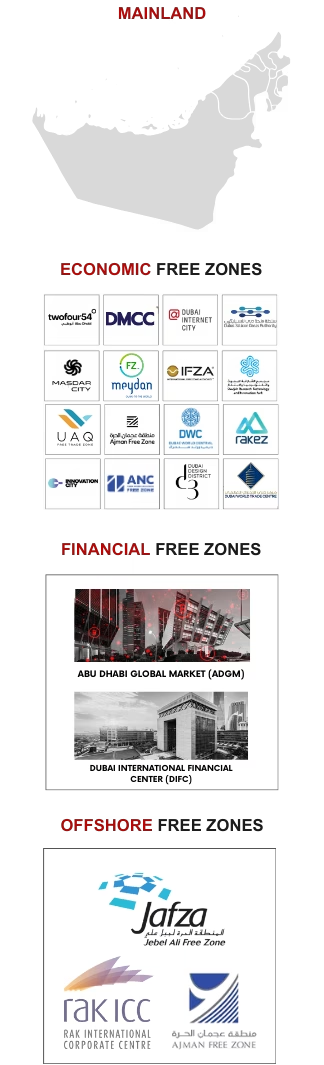

Setting up a crypto or Web3 company in the UAE requires selecting the right jurisdiction and the correct legal structure. The choice between mainland, free zone, or offshore company formation has significant implications for ownership, compliance, taxation, and operational flexibility. This guide helps founders navigate the setup process, from trade licensing to post-incorporation obligations.

UAE has 4 distinct company formation options, depending on the business model and VASP licensing requirements:

This guide outlines the end-to-end process of forming your entity in the UAE and helps you align your corporate structure with your product roadmap and investor expectations.

Failure to comply can result in fines or even suspension of operations.

Request a legal review of your business today and ensure full compliance with the UAE regulations.

UAE VASP Licensing Regimes

For founders launching regulated crypto projects, understanding the UAE’s Virtual Asset Service Provider (VASP) regimes is mission-critical.

The country offers multiple regulatory pathways, including VARA in Dubai, ADGM’s FSRA, DIFC’s DFSA framework, and the federal regimes covered by the CBUAE and SCA.

Each Regulator has its own rules, timelines, and capital requirements, but all demand strong compliance systems, financial controls, and local substance.

This guide explains the the licensing process in simple language by comparing the different jurisdictions side-by-side. You’ll learn which regulators cover which activities, how long approvals typically take, and what post-licensing obligations you must meet.

Key questions answered:

- How to prepare and apply for as VASP license in the UAE

- What’s the difference between all 5 UAE regulators: VARA, DIFC, ADGM, SCA, and CBUAE?

- How does ADGM regulate tokenized securities?

- Can you legally operate a DAO or DeFi protocol under any of these regimes?

This section provides legal clarity and practical guidance so you can choose the right Regulator, prepare your application with confidence, and align your legal strategy with your commercial goals.

Crypto Taxes in the UAE – What Founders Must Know

The UAE remains one of the most tax-efficient jurisdictions for individuals and companies, particularly for those involved in crypto trading or holding digital assets, as well as crypto founders and investors seeking long-term residency and wealth preservation.

- Individuals pay 0% income tax and 0% capital gains tax, whether from salaries, crypto trading, NFT profits, staking rewards, or Bitcoin appreciation.

- Companies are subject to 9% corporate tax on business profits and capital gains (effective for financial years beginning in June 2023). Any UAE business generating more than AED 375,000 in annual profit will be subject to corporate tax unless they qualify under an exempt category.

- Individuals who carry out advisory or consulting in their own name and receive over 1,000,000 AED in annual revenue are subject to corporate taxes as well.

Some Economic Freezones may still offer tax incentives, but these are conditional. To qualify, your company must limit business activity to within the free zone, avoid dealing with the UAE mainland, and comply with “Qualifying Income” rules. Missteps could nullify your exemption and expose your business to full corporate tax.

0%

for taxable income

up to AED 375,000

9%

for taxable income

above AED 375,000

15%

for Multi-National Enterprises (MNE)

Understanding your tax position is critical to avoiding penalties and preserving your gains. Talk to our UAE crypto-tax specialists to map the optimal tax structure and ensure full compliance from day one.

Bitcoin in the UAE – Legal, Tax-Efficient, and Growing

Bitcoin enjoys a well-defined legal position in the UAE. Under federal law, it is classified as a virtual asset as well as recognized as property.

While Bitcoin payments for goods and services will become restricted in retail settings from August 2025, investing, trading, and holding Bitcoin remains legal.

The UAE continues to attract long-term Bitcoin holders, miners, and institutional investors. Holding structures through personal or family-owned entities in free zones such as DIFC, ADGM, and RAK DAO enable highly efficient wealth management strategies.

Abu Dhabi has also emerged as a global Bitcoin mining hub, with large-scale operations powered by sustainable energy sources, including nuclear. Whether you’re a miner, HODLer, or fund manager, the UAE offers a regulated and tax-optimized environment for Bitcoin.

Venture Capital in the UAE

The UAE has become a hotspot for crypto-native venture capital, thanks to its flexible legal infrastructure, global connectivity, and tax fauvorable conditions . Whether you’re launching a fund, raising your seed round, or setting up an SPV for investment purposes, this chapter outlines the available legal vehicles and strategic considerations for venture capital in the UAE.

With both local and international VCs actively deploying capital in the region, founders and fund managers are increasingly choosing the UAE as their operational base. This guide features a curated list of Web3-native venture capitalists active in the UAE, making it easier for founders to identify, approach, and raise capital from the right investors.

Building a Team – Hiring for Crypto Startups in the UAE

Scaling a crypto company in the UAE requires more than tech talent; it requires compliance with the UAE Labour Laws. Every team member must be correctly engaged to avoid compliance risks. Employees need work permits, employment contracts, health insurance, and Emirates IDs. Freelancers, consultants and advisors must have clearly defined independent agreements that avoid triggering accidental employment rights.

The chapter on Labour Laws guides founders through the legal frameworks that apply when hiring teammates in the UAE. It breaks down the obligations you have as an employer, including end-of-service gratuity, payroll through the Wage Protection System (WPS), and medical coverage. For companies on the mainland, it also explains Emiratisation quotas and how to remain compliant as your headcount grows.

You’ll also learn how to draft airtight contracts that include confidentiality clauses, IP assignment, non-compete provisions, and legally sound termination terms. These are especially important in crypto, where founders often work with remote contributors, developers, and marketing agencies.

UAE Golden Visas and Residency for Crypto Entrepreneurs

Before you can live and work in the UAE, you need the correct residency visa . This chapter walks you through the legal pathways for securing long-term residency, including the highly sought-after 10-year Golden Visa for crypto entrepreneurs, investors, and tech professionals.

Whether you’re setting up a company, investing in real estate, or applying based on professional merit, the UAE offers flexible options to support your long-term presence in the region.

See if you qualify and get started with your Web3 Founder Visa application today.

Web3 Dispute Resolution in the UAE

As the UAE becomes a global hub for Web3 and crypto business, it is also strengthening its legal infrastructure for resolving disputes related to virtual assets, DAOs, token sales, and smart contracts. Founders need to understand how disputes are handled before they happen, including alternative dispute resolution such as Mediation, an increasingly popular way to solve disputes without going to court.

This chapter covers your dispute resolution options across the UAE’s multi-jurisdictional legal landscape:

- Mediation is a fast, confidential, and cost-effective method often encouraged in commercial and contractual disputes.

- International arbitration centers, such as DIAC and LCIA, offer enforceable awards and global neutrality for high-value disputes.

- Common law jurisdictions in DIFC and ADGM are ideal for tech and crypto businesses seeking familiar legal systems and English-language proceedings.

- Civil law courts in Abu Dhabi, Dubai, and Ras Al Khaimah are the default venues for onshore matters, governed by Arabic-language procedures and codified laws.

The court system is organized into three levels: Courts of First Instance, Courts of Appeal, and Courts of Cassation, with the Federal Supreme Court serving as the highest court at the federal level.

The Founder’s Guide packs ready-to-use templates, step-by-step checklists, practical roadmaps, and insights from the UAE’s leading crypto experts – then keeps you ahead of the curve with live updates on every new rule change.

Download the Guide Trusted by 3,500+ Founders

Everything you need to launch, raise, and grow in the UAE, legally and strategically.