TL;DR:

This is the 2026 guide for UAE Crypto KOL to staying safe, legal, and profitable as a crypto influencer in Dubai and across the UAE. If you post or promote crypto content in or targeting the UAE, you fall under at least four regulators, and at least 8 different pieces of legislation. Every post, video, or affiliate link must comply with their rules. Non-compliance can mean fines, takedowns, or even losing your permit.

Why Every UAE Crypto KOL in the UAE Must Read This

The UAE is one of the most crypto-friendly jurisdictions in the world, but it’s also one of the most regulated when it comes to media and marketing.

If you’re an influencer, YouTuber, or UAE Crypto KOL producing content in or targeting the UAE, your videos, posts, and affiliate links have to comply with a myriad of regulations.

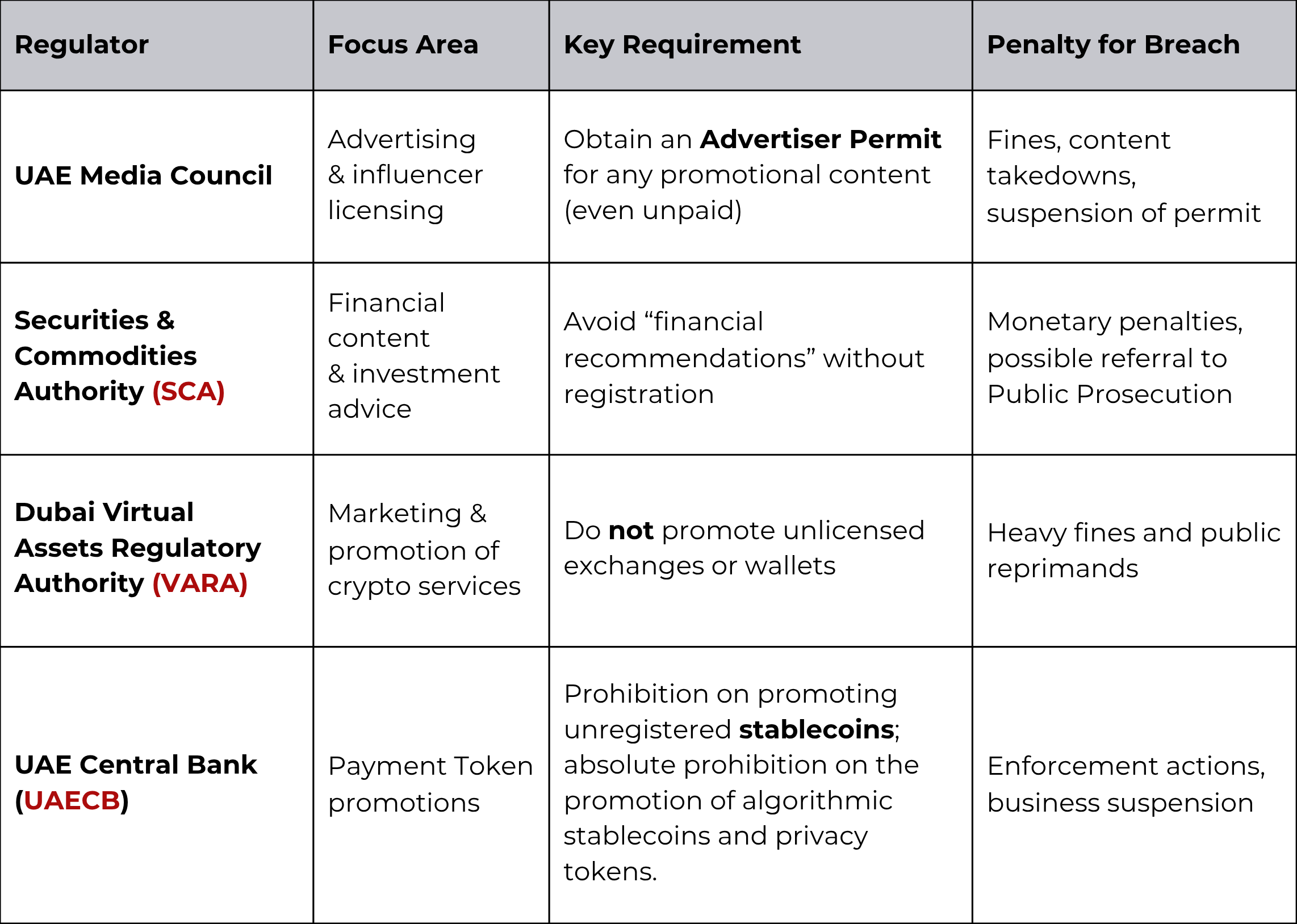

Four regulators: VARA, SCA, the UAE Media Council, and the UAE Central Bank – can have jurisdiction over what you publish. Missing a disclosure or tagging an unlicensed exchange can result in fines or even suspension of activity.

Here’s your clear 2026 roadmap to stay compliant while protecting your brand and income.

The 4 Regulators That Govern UAE Crypto KOL

The Most Common Mistakes Crypto Influencers Make

1. Missing or Inconsistent Disclaimers

Failing to display clear disclaimers across YouTube, X, and Instagram makes your content appear misleading. Every post should include visible on-screen and verbal disclaimers, with a link to a permanent disclosure page (e.g., via Linktree or your site).

2. Promoting Unlicensed Exchanges

Mentioning or tagging platforms that aren’t regulated by VARA or SCA is prohibited. Even indirect promotion, such as sharing referral links or screenshots, may be treated as marketing. Always verify your partners against the official Licensed VASP Register before posting.

3. Hiding Affiliate Links or Sponsorships

If you earn from referrals or paid mentions, UAE law requires you to label them visibly. Use “Ad”, “Sponsored”, or “Affiliate – see bio.” Hidden monetization is considered deceptive advertising under both VARA and Media Council rules.

4. Giving Investment Advice

Statements like “next 10x project” could fall under SCA Finfluencer rules. If you aren’t licensed as a financial advisor, focus on general educational content, talk about technology, not investment performance.

5. Posting Time-Sensitive Calls to Action

Using phrases like “buy before the pump” or “don’t miss this” creates artificial urgency. This is prohibited under VARA’s Marketing Regulations and can be seen as irresponsible promotion, especially if linked to unlicensed platforms.

6. Ignoring UAE cultural and content standards

Content that disrespects religion, culture, modesty, or national values can lead to immediate takedown or criminal investigation. Always follow UAE decency standards in speech, visuals, and humour.

7. Promoting Charities or Donations Without Permission

Charity promotion is tightly regulated. You can only promote registered UAE charities with prior written approval. Otherwise, it’s considered an illegal fundraising act.

What VARA Marketing Regulations Mean for UAE Crypto KOL

VARA’s Marketing Regulations, first issued in 2022 and amended in 2024, ensure that all crypto-related promotions in or targeting the UAE are ethical, transparent and compliant.

What Counts as “Marketing” Under VARA

VARA defines marketing far more broadly than most jurisdictions. If your content influences, encourages, or invites the public to interact with a Virtual Asset or Virtual Asset platform, it falls within scope.

This includes:

- Paid social media posts, affiliate campaigns, and referral links

- Mentions of exchanges, token projects, or trading apps in YouTube videos or Podcasts.

- Promotions at events or sponsored panels encouraging engagement with a VA or a VA platform

- Contests, giveaways, and airdrops that involve or distribute digital assets

Even foreign projects are covered if they target the UAE, for example, through Arabic subtitles, AED references, UAE landmarks, or influencers with large UAE-based audiences.

Who Is Allowed to Market Virtual Asset Services

Only licensed Virtual Asset Service Providers (VASPs) and their officially authorized representatives can market regulated activities.

If a VASP isn’t licensed in the UAE, local influencers and agencies are prohibited from promoting it in any form.

This restriction, however, does not prevent influencers from discussing Virtual Assets themselves, provided they do so educationally and neutrally.

Allowed

✓ Explaining how blockchain or tokens function

✓ Discussing general market trends

✓ Hosting interviews or panels about regulation

✓ Sharing factual comparisons of listed assets

Not Allowed

x Calling tokens “safe” or “guaranteed profit”

x Urging followers to buy/sell specific tokens

x Promoting or linking to unlicensed exchanges or wallets

x Using referral codes or affiliate links for unlicensed platforms

Mandatory Marketing Requirements for Influencers

To comply with VARA’s transparency and fairness standards, every influencer / UAE Crypto KOL must:

- Display clear risk disclaimers – on-screen in videos, visible in captions, and legible on images.

- Avoid misleading or manipulative tactics.

No “risk-free,” “guaranteed returns,” or “limited-time offers.” Creating urgency or fear-of-missing-out marketing is strictly prohibited. - Keep comparisons factual and balanced.

If you compare one platform or token to another, cite objective data. Never imply that past performance guarantees future success. - Disclose all paid promotions.

Sponsored content, brand partnerships, and affiliate campaigns must include clear labels such as “Ad” or “Sponsored,” in both the content and the description. - Maintain compliance records for at least two years.

VARA may audit your historical content, engagement metrics, and sponsorship data at any time.

Penalties for Non-Compliance

Failure to comply with VARA’s Marketing Regulations can lead to severe penalties, including:

- Fines between AED 500,000 and AED 10 million

- Suspension or permanent revocation of your right to market Virtual Assets

- Public enforcement notices that damage credibility and brand reputation

Understanding the SCA Finfluencer Regulation

The SCA Finfluencer Regulation (2025) governs anyone offering financial commentary or market insight.

It captures both:

- Direct recommendations – advising viewers to buy/sell specific tokens or assets.

- Public engagement – creating content that could influence investment behaviour.

UAE Crypto KOL s must carefully frame their content to remain outside the scope of this regulation, ensuring that their discussions are educational in nature and never perceived as financial advice by the audience.

Frame videos as general education: “This is not financial advice; This content is for general awareness and education only.”

UAE Media Law – Advertiser Permit and Content Standards

The Federal Media Law (Decree-Law 55/2023) applies to all social-media activity targeting UAE audiences.

You must:

-

-

- Obtain an Advertiser Permit from the UAE Media Council.

- Respect UAE cultural and religious norms.

- Avoid false or misleading claims.

- Remember that you are legally responsible for everything you publish, including reposts and collaborations.

-

Permit fees: free for first 3 years, AED 1,000 renewal thereafter for individuals, different rates apply for companies.

Tax Obligations

Influencer in the UAE who are licensed or otherwise conduct business in a personal capacity are treated as taxable businesses. This means they must comply with both Value Added Tax (VAT) and Corporate Tax (CT) obligations. Failure to comply can lead to penalties and reputational risks.

Influencers whose annual income exceeds AED 375,000 must register for VAT with the Federal Tax Authority (FTA). Once registered, they are required to charge 5% VAT on all taxable services, including payments received in cash or in kind.

VAT returns must be filed through the FTA portal on a quarterly basis. Timely and accurate filings are crucial, as late submissions or errors can result in fines and other enforcement measures.

As of June 2023, the UAE imposes Corporate Tax at 9% on both companies and individuals carrying out a business activity. This includes UAE Crypto KOL s/influencers. The tax structure distinguishes between business entities and sole practitioners:

Businesses operating under a trade license or company structure:

- Profits up to AED 375,000 are exempt from CT, while profits above this threshold are taxed at 9 percent. These businesses must file an annual corporate tax return, even if income falls below the threshold.

Individuals, Sole traders and freelance permit holders:

- Registration for CT is required only if net income exceeds AED 1,000,000 annually. Once registered, they are obligated to submit annual tax returns to the FTA.

How NeosLegal Helps Crypto Influencers Stay Safe and Profitable

NeosLegal specializes in influencer and KOL support, trusted by several of the industry’s biggest names.

Our services include:

- UAE Advertiser Permit applications

- VARA and SCA-compliant disclaimer systems (for YouTube, X, Instagram)

- Sponsorship and affiliate-review vetting

- Personal holding vehicles structuring

- Tax advice and optimization

Book your Strategic KOL Compliance Consultation today to protect your brand, revenue, and audience.

Frequently Asked Questions

1. Is it legal to be a crypto influencer in the UAE?

Yes – being a crypto influencer is fully legal in the UAE, but only if you follow the UAE’s marketing and financial-promotion laws.

You must hold a UAE Media Council Advertiser Permit, comply with VARA Marketing Regulations, avoid giving investment advice, and work only with licensed Virtual-Asset Service Providers (VASPs).

Non-compliance can lead to heavy fines and license suspension.

2. Do I need a license to post crypto content in Dubai or Abu Dhabi?

Yes. Any sponsored or promotional crypto content targeting UAE audiences requires a Media Council Advertiser Permit, even if unpaid. In addition, if you mention tokens, exchanges, or wallets, you must ensure they are licensed either by VARA (Dubai) or the SCA (mainland/UAE-wide).

VARA applies within Dubai and free zones like DMCC; the SCA regulates onshore UAE and other Emirates.

3. Can I promote a crypto exchange that isn’t licensed in the UAE?

No. There is a strict prohibition of promoting unlicensed exchanges, wallets, or token platforms. Only licensed VASPs or their authorized marketing partners can advertise regulated services.

Influencers should always verify their partners on the official VASP Register before publishing content.

4. What happens if I promote an unlicensed crypto company in the UAE?

Promoting an unlicensed entity can result in:

- Fines up to AED 10 million

- Takedown orders across social platforms

- Suspension of your advertising permit

- Public enforcement notices on VARA’s website

These actions can permanently damage your credibility with brands and regulators.

5. What disclaimers must I include in my videos and posts?

Every crypto-related post should include visible and verbal risk warnings. Disclaimers must appear on-screen, in captions, and on your bio or website link (for example, via Linktree). VARA and SCA treat missing or inconsistent disclaimers as misleading marketing.

6. Can I give financial advice if I am experienced in trading?

No, you cannot provide personalized financial advice unless you are a licensed financial advisor registered with the SCA.

You also cannot provide general financial advice, unless you are a licensed Finfluencer.

Even if you are an expert trader, phrases like “Buy this token” or “Next 10x project” fall under financial-advice regulations. Keep your content educational, focusing on technology or regulation rather than predictions.

7. Are airdrops, giveaways, and referral links allowed?

Only if they comply with VARA’s marketing rules. Airdrops or referral campaigns are considered crypto promotions and must involve licensed entities. You must disclose sponsorships clearly and include risk warnings. Any “giveaway” involving digital assets is subject to audit.

8. Do the rules apply to foreign influencers who target UAE audiences?

Yes. VARA and SCA have extraterritorial reach. If your videos have Arabic subtitles, use AED prices, feature Dubai landmarks, or tag UAE-based audiences, the regulators consider your content as “targeting the UAE.” You must comply even if you live abroad.

9. What are the tax obligations for UAE influencers?

Once licensed, influencers are treated as businesses for Corporate Tax (CT) and Value Added Tax (VAT) purposes.

- VAT: Register if annual income exceeds AED 375,000. Charge 5% on taxable services.

- Corporate Tax: Pay 9% on profits exceeding AED 375,000.

Freelancers and sole traders must register if annual income exceeds AED 1 million. Crypto-denominated payments must be valued in AED at the time of receipt for tax reporting.

10. What happens if I do not register for tax?

Failure to register or file accurate returns can trigger financial penalties, FTA audits, and potential permit suspension. Repeated violations may also affect your immigration and visa status, as tax compliance is tied to business licensing in the UAE.

11. Can I promote blockchain education or awareness content?

Yes, educational content is encouraged. Explaining blockchain technology, regulation, or trends is allowed, as long as it’s factual, neutral, and doesn’t recommend specific investments.

12. Can I collaborate with other influencers or agencies abroad?

Yes, but you remain responsible for all content targeting UAE audiences. If a foreign partner posts on your behalf, you must still ensure that all disclaimers, brand partnerships, and affiliate arrangements meet VARA, SCA, and Media Council standards.

13. Can I promote a charity or fundraising campaign on my channel?

Only if the charity is officially registered in the UAE and you have written approval from the Islamic Affairs and Charitable Activities Department (IACAD). Unauthorized fundraising or promotion of foreign charities is a criminal offense.

14. Do influencers need to keep compliance records?

Yes. VARA requires influencers to retain copies of marketing contracts, payment receipts, and performance data for at least two years. Regulators can request access during audits or investigations.

15. What if my audience is mostly international but I live in Dubai?

If you reside in Dubai or your content originates here, you are considered to be operating from the UAE and therefore must comply. Even if only a portion of your followers are in the region, UAE regulators can still assert jurisdiction.

16. How does NeosLegal help crypto influencers stay compliant?

NeosLegal supports top-tier influencers and KOLs across the UAE’s Web3 ecosystem. The firm assists with Advertiser Permit acquisition, VARA-approved disclaimers, contract and sponsorship vetting, tax structuring, and offshore payment setup for crypto income.

By staying compliant from the start, creators safeguard their income streams, maintain credibility with global partners, and operate confidently under UAE law.

17. What’s the best way to stay updated on UAE crypto influencer rules?

Follow official announcements from VARA, SCA, and the UAE Media Council, and subscribe to NeosLegal’s Crypto Law Alerts newsletter for real-time updates, case studies, and compliance checklists.

18. What makes NeosLegal different from other law firms?

NeosLegal is the UAE’s first crypto-native law firm, established in 2016 to support founders, creators, and investors operating in blockchain and Web3 sectors. The firm advises global exchanges, token projects, and high-profile influencers on licensing, marketing compliance, and legal structuring.

NeosLegal’s unique edge lies in its dual expertise, combining deep regulatory knowledge of the UAE ecosystem with a crypto-native, founder-first approach.

19. What services does NeosLegal offer to influencers and KOLs?

NeosLegal provides full legal, tax, and compliance support to influencers and KOLs, including:

- Applying for Advertiser Permits under the UAE Media Council.

- Drafting VARA- and SCA-compliant disclaimers for social platforms.

- Vetting sponsorships, brand deals, and affiliate programs.

- Setting up personal holding structures for crypto income.

- Managing VAT and Corporate Tax compliance.

- Advising on offshore entity formation for global monetization.

20. How can I contact NeosLegal for a consultation?

You can schedule a Strategic KOL Compliance Consultation directly here. Consultations can be arranged in person in the UAE or virtually via zoom. NeosLegal also offers tailored packages for influencers, founders, and digital-asset companies.

21. What’s the best way to stay updated on UAE crypto and influencer laws?

Subscribe to The Crypto Law Alerts newsletter by Irina Heaver on Substack, and connect with NeosLegal on LinkedIn. Regular updates include new VARA circulars, SCA regulations, enforcement news, and industry case studies.