TL;DR:

Taxes in the UAE.

The UAE remains one of the world’s most tax-friendly jurisdictions, with 0% personal income tax and no capital gains tax on crypto or other investments for individuals. Businesses, however, are now subject to a 9% corporate tax, including income from trading and capital gains, if annual profits exceed AED 375,000.

Certain free zones still offer limited tax incentives, provided the business trades strictly within the zone and meets all compliance requirements.

One of the key factors in the emergence of UAE as a global magnet for crypto and Web3 ventures is its business-friendly tax environment. While the UAE has been historically regarded as a tax-free hub, attracting international investors and entrepreneurs with its pro-business environment and absence of corporate taxes in the UAE, as the UAE’s economy matured, the need for a more robust and sustainable approach to public revenue became apparent.

In response, the UAE introduced the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (UAE Corporate Tax Law or UAE CT Law).

Broadly, the following tax regimes are currently applicable in the UAE:

- Corporate Tax (CT)

- Value Added Tax (VAT)

- Custom Duties

Corporate tax

The UAE CT Law was published on December 9, 2022, and is applicable to all businesses in the UAE including free zone companies, and in some cases to individuals. CT is applicable to operating income, i.e., the sale of services and goods, as well as capital gains once realized.

CT Law also provides for withholding tax, but the rate at the moment is 0%.

However, this can change in the future.

Effective date/periods: The UAE CT Law applies to the Financial Year (FY) commencing on or after June 1, 2023.

NOTE! File your first return by 30 September 2025.

Taxable person

The UAE CT applies to the following persons:

- Juridical persons, i.e. companies, that are incorporated in the UAE.

- Foreign juridical persons that are effectively managed and controlled in the UAE or have a permanent establishment in the UAE.

- Natural persons, i.e. individuals, who conduct business in the UAE that is subject to business licensing and have a turnover of over AED 1 million (excluding salary, personal investment income from trading shares or crypto, real estate investment income) per calendar year from such business activities. This includes explicitly individuals with freelance permits and with sole establishment license.

Taxable rate

Corporate tax is imposed on the taxable income at the following rates:

0%

for taxable income

up to AED 375,000

9%

for taxable income

above AED 375,000

15%

for Multi-National

Enterprises (MNE)*

*corporate group operating in more than one jurisdiction and having consolidated global revenues exceeding EUR 750 million in at least two of the previous four financial years, with effect from financial years starting on or after January 1, 2025, are subject to top-up tax with an effective tax rate of 15%.

SMALL BUSINESS RELIEF

Resident taxable persons with revenue equal to or below AED 3 million (for each relevant tax period) can elect to be treated as having no taxable income in that period and will not be obliged to calculate taxable income or complete a full tax return. The AED 3 million threshold applies to tax periods commencing on or after June 1, 2023 and applies only to subsequent tax periods that end on or before December 31, 2026 (unless extended).

By claiming SBR, you can enjoy simplified compliance requirements. However, you must register for CT and VAT as applicable and submit a simplified tax return.

Free Zone Person

Entities established in a Free Zone (FZ) would be considered as a qualifying free zone person (QFZP) upon satisfaction of the following conditions:

- Derive qualifying income from undertaking the activities as specified in the UAE CT Law.

- Maintain adequate substance in the UAE.

- Satisfy the de-minimis requirement as to revenue, i.e. non-qualifying revenue should not exceed lower of 5% of total revenue or AED 5 million.

- Not elect to be subject to the general corporate tax regime.

- Comply with transfer pricing rules and documentation requirements.

- Prepare and maintain audited financial statements.

QFZPs will be eligible for 0% CT until the expiry of the tax incentive period provided for in the legislation of the relevant FZ (unless renewed).

Failure to comply with any of the conditions at any time during the tax period would end the QFZP status from the beginning of the relevant tax period and for the subsequent four tax periods.

Tax Calculation

Taxable income

The taxable income will depend on the category of taxable person:

- Companies are subject to CT on worldwide income.

- Individuals subject to CT, are only taxed on income related to business activities in the UAE.

Exempt income

The following types of income are not considered in determining the taxable income:

- Dividends and other profit distributions received from resident juridical person.

- Income (dividend, capital gains) received from a participating interest subject to meeting the conditions of the participation exemption provision.

- Income of a foreign permanent establishment, subject to certain conditions.

Deductible expenditure

The UAE CT Law allows for deductibility of expenses incurred for the purposes of business, not incurred in deriving exempt income and not capital in the nature, subject to interest deduction limitation rules, restriction on entertainment expenses and certain non-deductible expenses such as donations, fines, penalties etc.

Tax loss

Taxable persons will be eligible to reduce their taxable income up to 75% by setting off against carried forward eligible tax losses, subject to certain conditions.

Foreign tax credit

Credit of tax paid on the same income in a foreign country is available to be set off against the CT liability.

Ready to calculate your tax exposure? Book your consultation here.

Special Regimes

UNINCORPORATED PARTNERSHIPS

Unincorporated partnerships or joint ventures are considered tax transparent unless an application is made to the Federal Tax Authority (FTA) to treat the unincorporated partnership as a taxable person. Persons conducting business as an unincorporated partnership are treated as individual taxable persons under the UAE CT Law.

FAMILY FOUNDATIONS

Family foundations can apply to the FTA to be treated as unincorporated partnerships subject to meeting certain conditions.

TAX GROUPS

The UAE CT Law permits companies under common ownership of more than 95% to form a Tax Group by filing an application to the FTA, subject to the satisfaction of certain conditions.

Administration

Taxable persons are subject to certain CT compliance requirements in the UAE.

For Companies

3 months from the date of establishment in the UAE (including Free Zone) or 3 months from the end of the FY of the person established under the legislation of a foreign jurisdiction whose place of effective management is in the UAE.

For Individuals

31 MARCH

of the subsequent calendar year, if they are subject to CT.

UPDATE OF THE CT REGISTRATION

Taxable persons are required to update their details on the FTA portal if changes took place (e.g., company renewal, manager replacement etc.) within 20 days of the change.

PENALTY

Failure to register within the specified period violates the CT Law regulations and may result in associated administrative penalties.

Maintenance of Records

Taxable persons deriving revenue exceeding AED 50 million in the relevant tax period and QFZPs are required to prepare financial statements (FS) as per IFRS and maintain audited FS.

Other records and documents supporting the information provided in a CT return and enabling the taxable person’s taxable income to be readily ascertained by the FTA are required to be maintained for a period of 7 years from the end of the tax period to which they relate.

UAE DTTs and TRC

Double Taxation Treaties/ Agreements (DTTs/ DTAs) are international treaties designed to ensure that the same income is not taxed twice by two different countries.

The UAE has established an extensive network of DTTs, with the purpose of exempting or reducing taxes on investment and profits from both direct and indirect taxes. Further, the adoption of base erosion and profit shifting (BEPS) measures has shaped the evolution of recent tax treaties, including anti-abuse safeguards to prevent companies from avoiding taxes.

The UAE signed the Organization for Economic Co-Operation and Development’s (OECD’s) BEPS Multilateral Instrument (MLI) in 2018, and the MLI entered into force in the UAE in 2019. The UAE has listed 114 DTTs as covered tax agreements under the MLI.

TRCs

The FTA issues Tax Domicile Certificates or Tax Residency Certificates (TRCs) on a case-by-case basis to UAE companies in operation for at least one year, with an office in the UAE and audited accounts.

A TRC is issued for a specific DTT and for a specified period. Individuals residing in the UAE can apply for a UAE TRC in order to avail tax treaty benefits, as applicable. The FTA grants TRCs to individuals on a case-by-case basis.

Tax Residency for Natural Persons (Individuals)

For individuals, being recognized as a UAE tax resident can have significant benefits. These include eligibility for a TRC which allows individuals to claim tax treaty benefits under DTTs. Additionally, UAE tax residency can provide a potential exemption from taxation on worldwide income in other jurisdictions.

Requirements for Natural Persons

A natural person is considered a UAE tax resident under Cabinet Decision No. 85 of 2022 if they meet at least one of the following conditions:

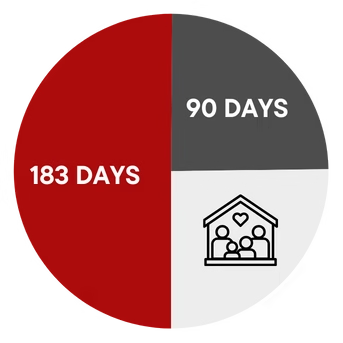

183-Days Rule

The individual was physically present in the UAE for 183 days or more in a 12-month period.

90-Days Rule

(for domestic purposes)

- The individual was physically present in the UAE for 90 days or more in a consecutive 12-month period,

and:

- They are a UAE or GCC national and hold a UAE residence permit.

- They have a permanent place of residence in the UAE or conduct employment or business in the UAE.

Common Reporting Standards (CRS)

The UAE has implemented automatic exchange of information (AEOI) regulations pursuant to international agreements to cooperate in the global effort towards tax transparency.

This happens through the following international frameworks:

- FATCA (for reporting to the US)

- CRS legislation (created by OECD for reporting to peer countries)

Under these rules, UAE reporting financial institutions (RFIs) are required to report account details of individuals and entities who are tax residents in other countries to the UAE Ministry of Finance, which then shares this data with foreign tax authorities.

All UAE RFIs are required to register on the UAE’s FATCA/ CRS portal: fatcacrs.mof.gov.ae.

NOTE!

If you are setting up a crypto-related business that qualifies as an RFI, it is important to check your obligations under these frameworks.

Value Added Tax (VAT)

The UAE implemented VAT with effect from January 1, 2018, under Federal Decree-Law No. 8 of 2017 (UAE VAT Law). The UAE VAT Law is based on the Common VAT Agreement of the Gulf Cooperation Council (GCC) States. However, VAT in the UAE is directly administered by the local tax authority, i.e. FTA).

5%

VAT Rates and Scope: The standard rate of VAT in the UAE is 5%, but some qualified supplies of goods or services may be subject to a special rate of 0% or be exempt from VAT subject to certain requirements.

Goods and services exported outside the VAT implementing GCC states, and other specific areas such as international transportation, supply of natural gas will qualify within the scope of qualified supplies.

Mandatory Registration:

> AED 375,000 = MUST

All local entities making taxable supplies or imports of goods or services exceeding AED 375,000 (in the last 12 months or next 30 days) are obliged to register for VAT.

Voluntary Registration:

< AED 375,000 = CAN

Entities making the above transactions or incurring taxable expenses between AED 187,500 and AED 375,000 (in the last 12 months or in the next 30 days) can apply for VAT registration on a voluntary basis.

VAT Treatment in Free Zones:

Under UAE VAT Law, entities established in free zones are considered to be mainland entities for VAT purposes and have the same VAT registration and compliance obligations. Some FTZs are considered to be designated zones for VAT purposes. There are special rules for the VAT treatment of the supply of goods to, from and within these designated zones.

VAT Return Filing and Payment:

VAT registered entities are required to file quarterly returns. VAT returns and any associated VAT liability payments are due to be submitted to the FTA by the 28th day of the month following the end of the VAT return period. In case the deadline for filing the return or making payment ends on public holiday or weekend, then the deadline will automatically extend to the next working date.

Input VAT Recovery and Refunds:

Businesses may obtain an input VAT credit for any VAT incurred on expenditure subject to the normal rules of VAT recovery. VAT refunds may be requested from the FTA where the VAT incurred on purchases exceeds the VAT payable on sales.

Clarifications and Guidance:

Clarification requests can be submitted to the FTA where there is uncertainty in the application or interpretation of VAT legislation and the results of these private clarifications are specific to the facts of the requestor. The FTA periodically publishes public clarifications and sector specific VAT guides. Therefore, it is important for taxpayers to remain up to date with the continually evolving VAT legislation.

Penalties:

The FTA can impose administrative penalties for non-compliance and under-declaration of VAT. These penalties are fixed and/or percentage based and, in cases of late or under declaration of VAT, may be up to 300% of the underpaid tax.

Trade and Customs

The UAE is a Member State of the GCC. Accordingly, the UAE is part of the GCC Customs Union; as such, it acts frequently as a first point of entry of goods into the GCC. Goods that are intended to be delivered to UAE mainland, subject to custom duty whereas, the goods delivered/intended to be delivered to FTZs are free from levy of such duty.

5%

Most goods entering the UAE are subject to the standard duty rate of 5% of the CIF (Cost, Insurance, and Freight) value of the goods. Some goods imported are subject to a 0% duty rate while other goods are taxed at higher rates (e.g. tobacco and alcoholic beverages).

Generally, duties are paid once at the point of entry into the GCC; no further duties would apply when goods are transferred within GCC states if complied with the ‘Makasa’ process, and the collected duties are then redistributed to the destination country where finally the goods are consumed.

Benefits under Custom Duty Deferment Regimes:

- Under a specific set of requirements, licensed entities in the UAE can benefit from several custom duty deferment regimes, such as free trade zones, customs warehouses, and temporary admission. Businesses can benefit from this warehouse benefit by requesting for a warehouse license to store the imported goods under the supervision of custom authority and have to pay certain amount depending on the size and type of warehouse one’s require without paying any custom duty on it.

- Customs duty exemptions may be available when importing goods into the UAE subject to meeting certain conditions, e.g. GCC originating goods, industrial exemption for raw materials and equipment, exemption on diplomatic goods, and exemption on imports made by Foundations (charities), among others.

- Subject to GCC Common Customs Law, the UAE Ministry of Economy may issue a certificate of origin for locally obtained or produced goods which may support the UAE/GCC origin to said products allowing to be exempted from custom duties under the GCC Unified Economic Agreement.

- Goods of UAE origin may also receive preferential customs duty treatment within the Greater Arab Free Trade Area (GAFTA) under the free trade agreement signed between the member states of the League of Arab States.

- As a GCC member state, the UAE enjoys the benefits of the free trade agreements signed between the GCC and other international trade actors, such as EFTA States and Singapore. Furthermore, the UAE has signed bilateral Comprehensive Economic Partnership Agreements (CEPAs) with different countries such as India, Indonesia, Turkey, among others, which also provide preferential customs duty treatment to originating goods from any of the contracting parties within the relevant CEPA.

Dubai Property Transfer Fee

4%

A registration fee is applicable on transfer of real estate, which varies from emirate to emirate. For example, within the Emirate of Dubai, the fee is 4% of the property transfer value.

It is always better to verify the relevant transfer fee with the local land department of the specific emirate where the property is located to obtain accurate and up-to-date information.

Regulation of Procedures Related to Real Beneficiaries

On November 6, 2023, the UAE Ministry of Economy published Cabinet Decision No. 109/2023 (the Decision) on the Regulation of Procedures Related to Real Beneficiaries, which repealed and replaced the previously subsisting 2020 resolution (UAE UBO Regulation).

The UAE UBO Regulation requires companies based in the UAE mainland and commercial free zones to maintain registers of their beneficial owners and shareholders, and to disclose the complex ownership arrangement and related information. Further, it requires that the companies file their registers with the relevant registrar and licensing authorities within 60 days from the date of promulgation of the original regulation, i.e. October 27, 2020 (for existing entities) or at the time of incorporation of a new entity to their respective registrars.

Companies must notify the Registrar of any change or amendment to the information provided within 15 days of such change or amendment. The information maintained in the register could be shared by the Ministry of Economy with foreign governments at their request, as per international cooperation measures.

These rules do not apply to companies established in the UAE’s financial free zones (such as DIFC or ADGM) or to companies which are wholly owned by the federal or local government.

Book a call with our tax lawyer today to structure your taxes right.