TL;DR:

Q3 2025 was busy across all five UAE regulators. VARA formalised issuer rules for FRVA/ARVA (stablecoins & RWAs) and stepped-up enforcement. SCA adopted a Security & Commodity Token regime and consulted on tokenised sukuk. ADGM/FSRA refreshed its VA guidance and opened a new consultation. CBUAE ended the Payment Token transition. DIFC launched a PropTech Hub, and DLD ran sold-out property-title tokenization pilots.

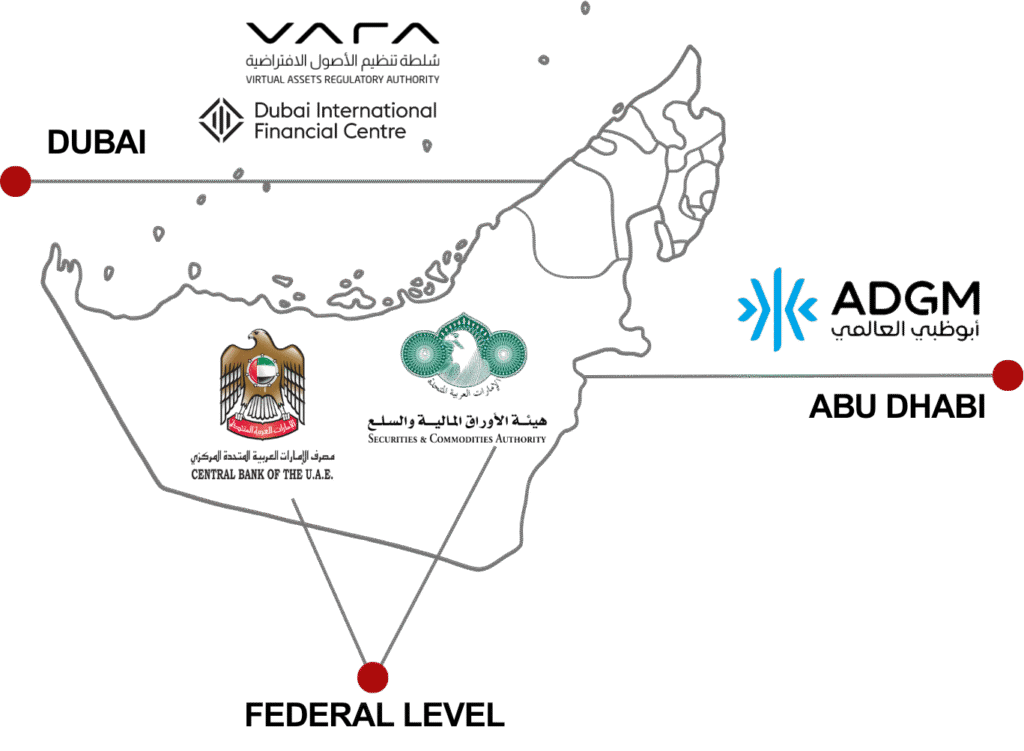

UAE Crypto Regulations at a glance (2025)

VARA’s Issuance Rulebook (FRVA/ARVA): What changed and why it matters

On 19 June 2025, VARA’s Virtual Asset Issuance Rulebook became effective.

It locks in approval and disclosure mechanics for issuers and, crucially, spells out how Fiat-Referenced Virtual Assets (FRVA) and Asset-Referenced Virtual Assets (ARVA) are treated.

Both FRVA and ARVA are Category 1 VA Issuances, triggering full VA-activity obligations, whitepaper/risk disclosure duties, and, for FRVAs, reserve asset rules under VARA oversight. If you’re planning on issuing a stablecoin or an RWA, this is now your starting line.

Further reading: your Forbes RWA Issuance Guide.

SCA’s Security & Commodity Token Contracts

In late June, the UAE Securities and Commodities Authority (SCA) adopted Decision No. 15/RM/2025, creating a legal framework for Security Tokens and Commodity Token Contracts issued from or in the UAE. It aligns tokens with existing securities/commodity laws and adds DLT-specific disciplines: technical standards, disclosure duties, and where tokens can be traded and settled.

Key point: trading/settlement must occur on a licensed Market or an Alternative Trading System.

RWAs are specifically excluded under security tokens, as long as the underlying asset is not a security.

Consultation (June): tokenised sukuk.

SCA also ran a consultation enabling the sale and purchase of fractionalised bonds and sukuk, a clear enabler for tokenised sukuk and wider investor access.

ADGM/FSRA: guidance refresh (June) + new consultation (July)

On 10 June 2025, ADGM’s FSRA implemented amendments to its digital-asset framework and updated its Guidance – Regulation of Virtual Asset Activities in ADGM. Highlights include a streamlined path for recognising Accepted Virtual Assets (AVAs), refined capital/fee settings for VA firms, and explicit confirmation of the prohibition on privacy tokens and algorithmic stablecoins.

On 30 July 2025, FSRA published Consultation Paper No. 8/2025 for further enhancements (comments closed 27 August 2025).

Bottom line: ADGM remains pro-innovation with crisp, institutional-grade guardrails.

CBUAE Payment Token Services Regulation (PTSR): What merchants and PSPs must do now

The Central Bank of the UAE’s PTSR moved out of transition in August 2025, flipping from “prepare” to “comply now.” In practice, any entity offering payment token services on the UAE mainland (outside financial free zones) must be licensed/registered under the Central Bank regime.

General consumer payments are limited to CBUAE-approved, AED-pegged stablecoins (often called Dirham Payment Tokens).

Foreign tokens operate in narrower lanes (e.g., buying VAs), not broad retail checkout.

ADGM/FSRA: Consultation Paper No. 9 of 2025 (Fiat-Referenced Tokens)

On 9 September 2025, ADGM’s FSRA released Consultation Paper No. 9 of 2025 proposing a full framework for regulated activities involving fiat-referenced tokens (FRTs), building on the December 2024 regime that made FRT issuance a distinct regulated activity. The paper keeps issuance intact, but expands oversight to acceptance, custody, payment services using FRTs, and a new “FRT intermediation” activity (buy/sell on behalf of clients/issuers) with proportionate prudential and conduct rules.

Feedback is open until 7 October 2025.

DIFC PropTech Hub: Sandbox-to-scale for real-estate tokenization

In July, DIFC and Dubai Land Department launched the Dubai PropTech Hub inside the DIFC Innovation Hub, an innovation district aimed at supporting 200+ PropTech startups/scaleups, creating 3,000+ jobs, and attracting $300m by 2030. It gives real-estate tokenization teams a clearer path from sandbox to scale with regulator touchpoints built in, aligned with Dubai’s D33 agenda and Real Estate Strategy 2033.

DLD Property Title Tokenization: early metrics

Dubai Land Department’s Real Estate Tokenization pilot – run with partners PRYPCO Mint and CtrAlt, in collaboration with VARA, the Central Bank, and Dubai Future Foundation – has already delivered sold-out issuances, signalling real demand for on-chain title.

The inaugural asset drew 224 investors from 44 nationalities with an average ticket of roughly AED 10,714, while the second sold out in one minute and 58 seconds with 149 investors; together, the first two properties raised about USD 1.3 million. To anchor investor rights, DLD also introduced a Property Token Ownership Certificate, and listings continue to expand as processes standardise and demand persists.

Enforcement pulse: VARA vs Morpheus (Fuze) + marketing rules

In mid-August, VARA announced enforcement action (including a financial penalty) against Morpheus Software Technology FZE (Fuze) for AML programme failures, governance/compliance gaps, and conducting unlicensed VA activity in breach of licence conditions. Message: licences are not trophies, they’re ongoing obligations. Expect deeper supervisory attention to AML, disclosures, and your true activity perimeter.

Marketing & promotions (founder tip): Align websites, decks, and influencer activity to the UAE crypto regulation marketing rules. Avoid FOMO, add mandatory risk wording, and maintain a log for all public claims.

Want a zero-drama route to launch? Book a 20-minute call with us.

We’ll pick the right venue (VARA / SCA / ADGM), pressure-test your token model (FRVA/ARVA/security), align your payments to PTSR, and deliver a legal blueprint you can execute this week.

Frequently Asked Questions

Is an RWA token a security in the UAE?

Not necessarily. Under SCA’s framework, RWAs are not securities so long as the underlying asset is not a security.

What’s the difference between FRVA and ARVA under VARA?

FRVA are fiat-referenced (e.g., AED-pegged stablecoins) and carry reserve/custody duties;

ARVA reference baskets of assets (e.g., commodities, property interests);

Both trigger Category 1 issuance obligations with robust disclosures.

Can UAE merchants accept USDT/USDC at checkout?

General retail payments are limited to CBUAE-approved, AED-pegged stablecoins (Dirham Payment Tokens). Foreign tokens sit in narrower use cases (e.g., buying VAs), not broad retail checkout.

How do I choose VARA vs SCA vs ADGM?

Map your product and token classification first. Exchange/ATS needs or on-shore securities often suggest SCA; Dubai VA activity suggests VARA; Abu Dhabi ecosystem/listability may favour ADGM.

What is tokenised sukuk and where can it trade?

SCA consulted on enabling fractionalised bonds and sukuk and allows trading/settlement on licensed markets/ATS, with a limited OTC carve-out for bonds/sukuk tokens.