TL;DR:

- Setting up a crypto or Web3 business in the UAE is a legal and regulatory process, not just company incorporation;

- A trade licence is NOT a regulatory licence, it only confirms legal existence, not permission to conduct crypto activities;

- Businesses engaging in Virtual Asset Service Provider (VASP) activities must obtain regulatory approval from the relevant authority. Non-compliance can result in fines up to AED 1 billion and personal liability for founders and managers;

- Founders can establish companies in mainland UAE, economic free zones, financial free zones (DIFC v ADGM) or offshore jurisdictions, each with distinct legal, tax, and operational consequences;

- After incorporation, companies must meet ongoing obligations, including trade licence renewals, UBO filings, tax registration, audits, compliance, and proper wage payments;

NeosLegal supports crypto founders end-to-end, from structuring and licensing strategy to incorporation, banking, and ongoing regulatory advisory, having structured over 300 crypto and Web3 projects in the UAE and internationally since 2016.

Key Answers for Founders (2026)

Can I start a crypto company in the UAE without a regulatory license?

Only if your activity is demonstrably non-VASP. A trade licence alone is not sufficient for exchanges, custody, brokerage, issuance, or facilitation.

Is VARA the only crypto regulator in the UAE?

No. Crypto is regulated by VARA (Dubai), FSRA (ADGM), CMA (federal), DFSA (DIFC), and the Central Bank, depending on activity and location.

What is the fastest compliant setup timeline?

Properly structured crypto companies can be operational within 30 days, excluding regulatory VASP licensing.

What is the biggest founder mistake?

Incorporating first and analysing regulation later, which often leads to unbankable or illegal structures and huge penalties.

Table of Contents

- What Does “Setting Up a Crypto Company” Mean Under UAE Law?

- Trade Licence vs Crypto Regulatory Licence in the UAE (Why Founders Get This Wrong).

- Who Regulates Crypto in the UAE? VARA, ADGM, CMA, DIFC & Central Bank Explained.

- What Activities Trigger Crypto Regulation in the UAE?

- Can a Dubai Company Issue Tokens Without a Licence?

- Structural Options for Establishing a Crypto Business in the UAE.

- Mainland UAE Companies: Legal Framework and Structures.

- Free Zones: The Preferred Choice for Crypto and Web3 Founders.

- Corporate Governance and Management Requirements.

- From Idea to Entity in 30 Days: A Founder-Ready Crypto Company Formation Timeline.

- The Role of Specialist UAE Crypto Lawyers.

- How NeosLegal Supports Crypto Founders.

- Frequently Asked Questions (FAQs).

What Does “Setting Up a Crypto Company” Mean Under UAE Law?

Founders often arrive in the UAE with the assumption that setting up a crypto or Web3 company is primarily an administrative task. In practice, it is a legal and regulatory exercise that must begin long before incorporation documents are signed and filed.

Under UAE law, no business may operate without a valid “trade license” or “business licence” and operating without one is an offence subject to penalties. However, for crypto and Web3 founders, incorporation is only the first gate.

The UAE legal system distinguishes very clearly between the existence of a company and the regulation of its activities.

A trade licence confirms that a legal entity has been validly established and exists. It does not authorise the company to engage in regulated financial or virtual asset activities. This distinction is central to understanding the UAE crypto landscape and is one of the most common points of failure for new entrants.

A trade licence is typically issued for one year and must be renewed annually. Renewal is not automatic; it is conditional upon ongoing compliance with corporate, tax, immigration, and regulatory obligations. It is also conditional upon making annual renewal payments to the Registration Authority. A company that fails to meet these obligations risks penalties, non-renewal, and suspension.

Where founders intend to engage in activities that fall within the definition of a Virtual Asset Service Provider, regulatory approval becomes mandatory. Non-compliance carries severe consequences, including administrative fines of up to AED 1 billion or a certain percentage of annual revenue, disgorgement of profits, and potential referral of founders and senior managers to the Public Prosecutor.

These risks are personal, meaning if you are a founder, director, or manager those risks apply directly to you, not just to your company.

Trade Licence vs Crypto Regulatory Licence in the UAE (Why Founders Get This Wrong)

A trade licence proves that a company exists.

A regulatory licence determines what the company is legally allowed to do. This distinction is foundational to the UAE’s regulatory architecture.

A trade licence is issued by a licensing authority, such as a Department of Economic Development or a free zone authority. It confirms the company’s legal standing and lists permitted business activities in broad commercial terms. It does not assess the underlying business model, technology, custody arrangements, or token mechanics.

A regulatory licence, by contrast, is issued by a financial or virtual asset regulator, such as Dubai’s Virtual Assets Authority (VARA) or UAE’s Federal Capital Markets Authority (CMA, formerly SCA). It authorises specific activities such as exchange operation, brokerage, custody, RWA tokens issuance, or advisory services relating to virtual assets. Regulatory licensing involves capital requirements, governance rules, compliance frameworks, AML obligations, reporting duties, and ongoing supervision.

One of the most dangerous misconceptions among founders is the belief that holding a free zone crypto-related licence or a broadly worded “blockchain services” activity allows unrestricted crypto operations. In reality, regulators assess substance over form.

Who Regulates Crypto in the UAE?

VARA, ADGM, CMA, DIFC & Central Bank Explained

Activity | Regulator |

|---|---|

Crypto exchanges, brokers, custodians (Dubai) | |

Crypto exchanges, custody, tokenisation (Abu Dhabi) | |

Securities / public offerings | |

Funds / investment products | |

Payments / fiat rails / stable settlement |

Crypto regulation in the UAE is not handled by a single authority. Instead, it is governed through a multi-regulator framework, where oversight depends on what activity is being performed, where it is performed, and who the target users are.

The UAE has built a modular regulatory architecture designed to accommodate different types of virtual asset and Web3 businesses without forcing them into a one-size-fits-all regime.

For founders, this means one thing: there is no universal “UAE crypto licence.”

The applicable regulator is determined by the substance of the activity, not by the label used in the business plan or on the website.

At a high level, crypto and virtual asset activities in the UAE are regulated by a combination of federal regulators, Emirate-level regulators, and financial free zone authorities.

At the federal level, the Capital Market Authority (CMA) , formerly the Securities and Commodities Authority (SCA), sets the overarching framework for capital markets, securities, and certain virtual asset activities that fall outside dedicated free-zone regimes.

The CMA plays a key role in defining the regulatory perimeter and coordinating with other authorities, particularly where activities touch securities, investment products, or public offerings.

In the Emirate of Dubai (outside financial free zones), crypto and virtual asset activities are regulated by the Virtual Assets Regulatory Authority (VARA).

VARA is responsible for licensing and supervising Virtual Asset Service Providers operating in Dubai, including exchanges, brokers, custodians, advisory services, and certain token-related activities. VARA applies a purpose-built virtual assets framework, with activity-specific licences and detailed compliance requirements.

In Abu Dhabi, crypto and virtual asset activities conducted within the Abu Dhabi Global Market (ADGM) fall under the supervision of the Financial Services Regulatory Authority (FSRA).

ADGM operates under a common law system and regulates virtual asset activities as financial services, applying a mature, institution-grade regulatory framework. ADGM is often used for exchanges, custodians, tokenisation platforms, funds, and sophisticated institutional structures.

The Dubai International Financial Centre (DIFC), regulated by the Dubai Financial Services Authority (DFSA), also plays a role in the broader digital assets landscape, particularly in relation to investment products, funds, and market infrastructure involving digital assets, subject to its own regulatory perimeter.

Separately, the Central Bank of the UAE (CBUAE) retains authority over payment systems, stored value facilities, and certain fiat-linked or payment-related token activities. Where a crypto business touches fiat payment rails, wallets, or stable settlement mechanisms, central bank oversight may become relevant even if the core activity is otherwise licensed elsewhere.

The practical consequence of this framework is that multiple regulators may be relevant to the same business, depending on how it is structured.

A company may be incorporated in a free zone, licensed by one authority, subject to AML supervision by another, and scrutinised by banks applying their own risk frameworks informed by all of the above.

This is why regulatory analysis must precede incorporation. Choosing a jurisdiction or free zone without understanding which regulator will ultimately have authority over the activity often leads to misclassification, delayed licensing, failed banking applications, or the need to restructure after launch.

Read next: UAE Crypto Licensing & Regulations 2026: The Complete Founder’s Guide (Detailed licensing triggers, activity mapping, and founder risks)

What Activities Trigger Crypto Regulation in the UAE?

Crypto regulation in the UAE is activity-based, not label-based. Regulators assess what a business actually does in practice, not how it describes itself on a website, pitch deck, or trade licence application. Calling a product “software,” “infrastructure,” or “technology services” does not remove regulatory exposure if the underlying activity falls within regulated virtual asset services.

In broad terms, crypto regulation is triggered when a business intermediates, controls, safeguards, facilitates, or monetises transactions involving virtual assets.

The most common regulated activities include:

- Operating a virtual asset exchange, including order books, matching engines, or automated trading mechanisms.

- Providing custody or safekeeping of client virtual assets, including wallets where the business controls private keys or recovery mechanisms.

- Brokerage or facilitation of virtual asset transactions, even where trades are executed on third-party platforms.

- Issuance of tokens with economic rights, such as profit participation, redemption rights, asset-backing, or yield-generating features.

- Operating fiat on-ramps or off-ramps, including payment processing or settlement involving virtual assets.

- Advisory or promotional services where the business influences investment decisions or token purchases for consideration.

By contrast, certain activities may fall outside regulated scope when structured correctly. These can include pure software development, non-custodial technology tools, analytics platforms, or infrastructure that does not intermediate transactions or control user assets. However, these distinctions are highly fact-specific and often misunderstood.

A common mistake among founders is assuming that regulation applies only to large exchanges or custodians. In reality, many early-stage Web3 businesses inadvertently trigger regulation through fee structures, token mechanics, or user flows that place them in the transaction chain.

Because UAE regulators apply a substance-over-form approach, regulatory analysis should always precede incorporation, product launch, and banking applications. Misclassification can lead to unauthorised activity findings, significant administrative fines, disgorgement of revenues, and personal liability for founders, directors, and managers.

Understanding whether your activity triggers regulation is the single most important decision point in any UAE crypto company setup.

Can a Dubai Company Issue Tokens Without a Licence?

Yes, a Dubai company can issue tokens without holding a regulatory licence, but only in narrowly defined and carefully structured scenarios. Whether regulatory approval is required depends on what rights the token confers, how it functions in practice, and how it is distributed, not on how it is labelled or marketed.

VARA applies a substance-over-form approach. Tokens described as “utility,” “community,” or “governance” may still be regulated if they create economic expectations, confer financial rights, or place the issuer in the transaction chain.

In practice, a regulatory licence may not be required where the token is a closed-loop token or a true utility or governance token, meaning it does not grant profit participation, yield, redemption, or asset-backed rights; and it functions primarily as access, usage, or governance tooling within a closed or technical ecosystem.

However, even where the issuer itself does not require an issuance licence, VARA’s issuance framework can still require that placement or distribution is conducted through (or by) a VARA-licensed distributor, typically a licensed broker-dealer and/or exchange, rather than via informal or unregulated channels.

These determinations are highly fact-specific, and small changes to token design, distribution mechanics, or issuer involvement can shift a token into regulated territory.

Structural Options for Establishing a Crypto Business in the UAE

Entrepreneurs seeking to establish a crypto or Web3 business in the UAE must select a jurisdictional structure that aligns with their business model, regulatory exposure, banking needs, and growth plans.

Broadly, three options exist: mainland UAE, free zones, and offshore jurisdictions.

- Mainland companies are registered with the Department of Economic Development of a specific Emirate. They operate under the UAE civil law framework and are subject to federal commercial legislation.

- Free zones are semi-autonomous jurisdictions with their own licensing authorities and internal regulations.

- Offshore entities, by contrast, are not permitted to conduct business within the UAE and are typically used for holding or structuring purposes.

Each option has legal, operational, and regulatory implications that must be assessed carefully at the outset.

Structure | What it is | Best for | Key advantages | Key limitations |

|---|---|---|---|---|

Mainland (Onshore UAE) | Company registered with an Emirate’s Department of Economic Development (DED) under UAE federal law. | Founders needing direct onshore presence or UAE-wide commercial activity. | Can operate across the UAE; widely recognised; 100% foreign ownership in most sectors. | More formal processes; Arabic documents legally binding; Emiratisation thresholds may apply. |

Economic Free Zones | Company incorporated in a UAE economic free zone under the zone’s regulations. | Most Web3 startups, software platforms, and non-regulated token projects. | 100% foreign ownership; fast setup; English documentation; crypto-friendly ecosystems. | Onshore activity may require arrangements; banking depends on substance; trade licence ≠ regulatory approval. |

Financial Free Zones (ADGM / DIFC) | Companies operating under common law frameworks in ADGM or DIFC. | Regulated crypto, tokenisation platforms, funds, institutional structures. | High legal certainty; investor-grade governance; strong regulatory credibility. | Higher compliance burden; higher costs; regulator engagement required (FSRA / DFSA). |

Offshore Zones | Offshore holding entities not permitted to operate in the UAE. | Holding shares, IP, assets, or international structuring only. | Simple holding structures; asset ownership use cases. | Cannot operate in the UAE; banking friction; often replaced by ADGM SPVs. |

Mainland UAE Companies: Legal Framework and Structures

Mainland businesses operate under the Federal Commercial Companies Law and the UAE Civil Transactions Law. These entities are registered at the Emirate level and are subject to federal and local oversight.

The most common mainland structure is the Limited Liability Company.

An LLC may have between one and fifty shareholders, and liability is limited to the amount of share capital contributed. Since the removal of the mandatory 51 percent Emirati ownership requirement for most sectors, foreign founders may fully own mainland companies in a wide range of industries.

A mainland LLC offers flexibility and the ability to operate directly within the UAE market. However, it may also be subject to Emiratisation requirements, Arabic-language documentation obligations, and more formalised government processes. For crypto founders, mainland structures are typically used where there is a strong operational or commercial reason to be onshore, such as local service delivery or regulated financial activity.

Branches of foreign companies are another option. A branch does not have a separate legal personality and operates as an extension of its parent company via a power of attorney. The parent remains fully liable for the branch’s activities, and the branch may only conduct activities identical to those of the parent. This structure is common for established international firms expanding into the UAE but is rarely suitable for early-stage crypto startups.

Civil companies and sole establishments exist, but are generally unsuitable for crypto businesses due to unlimited personal liability and structural limitations.

The Evolution of Ownership Rules in the UAE

Until recently, most mainland businesses required a UAE national to hold a majority ownership stake. This changed with sweeping legislative reforms introduced through Federal Decree-Law No. 26 of 2020 and consolidated under the Commercial Companies Law. Today, foreign investors may own 100 percent of mainland companies in most sectors, with only a limited number of strategic activities remaining restricted.

This reform fundamentally transformed the UAE’s investment landscape and removed one of the key historical barriers to foreign founders. However, ownership liberalisation did not remove regulatory oversight. Crypto businesses remain subject to licensing, compliance, and supervision regardless of ownership structure.

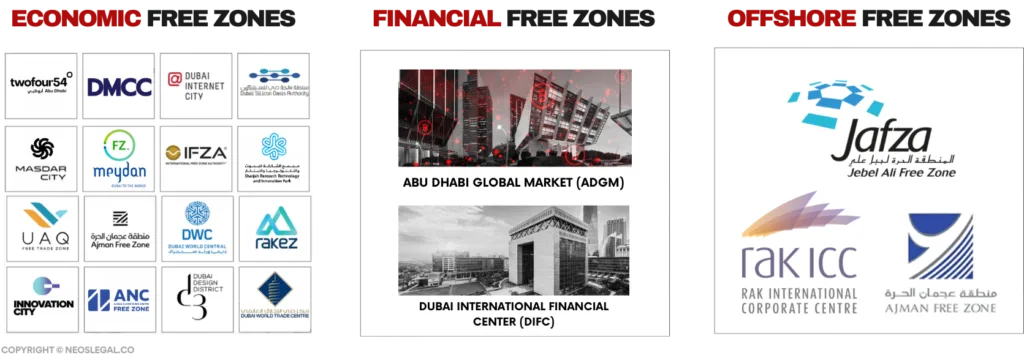

Free Zones: The Preferred Choice for Crypto and Web3 Founders

Free zones remain the most popular option for crypto founders entering the UAE. These jurisdictions were designed to attract foreign investment by offering simplified incorporation processes, operational flexibility, and ownership certainty.

Free zones are generally divided into:

- financial free zones,

- economic free zones, and

- offshore free zones.

Each category serves a different purpose and operates under a distinct legal framework.

Financial free zones, such as the Dubai International Financial Centre and the Abu Dhabi Global Market, are governed by the Federal Law No. 8 of 2004. These zones are exempt from most federal civil and commercial laws and instead operate under their own legal systems. The ADGM has directly adopted English common law, while the DIFC operates a common law-based framework with its own courts and judiciary.

These zones are particularly attractive to financial institutions, fintech companies, tokenisation platforms, and regulated crypto businesses. They offer a level of legal certainty and judicial sophistication that is familiar to international founders and investors.

Economic free zones, by contrast, operate within the UAE federal legal system but have their own licensing authorities and internal regulations. The UAE hosts more than 45 economic free zones, many of which actively court blockchain, crypto, and Web3 companies. Zones such as DMCC have launched dedicated crypto centres to support industry growth.

Offshore free zones, such as RAK International Corporate Centre (RAK ICC), JAFZA Offshore, and Ajman Offshore, represent a distinct category within the UAE’s company formation landscape. These entities are designed primarily for holding and structuring purposes, including ownership of shares, intellectual property, real estate, and other assets, as well as international trading conducted outside the UAE. Offshore companies are not permitted to conduct commercial operations within the UAE, do not hold trade licences, and cannot employ staff locally.

Offshore Free Zones and the Rise of ADGM SPVs

Offshore free zones such as RAK ICC, JAFZA Offshore, and Ajman Offshore historically served as popular vehicles for asset holding, international trading, and wealth structuring. These entities cannot conduct business within the UAE and have limited operational functionality.

In recent years, the introduction of cost-effective Special Purpose Vehicles (SVP) in the ADGM has significantly reduced the relevance of traditional offshore structures. ADGM SPVs offer modern governance frameworks, improved banking access, and stronger regulatory credibility. As a result, many founders now prefer ADGM SPVs for holding and structuring purposes.

Comparative Overview of Structural Options

| Feature | Mainland UAE | Free Zones | Offshore |

|---|---|---|---|

| Foreign ownership | Generally 100%, with some exceptions | 100% | 100% |

| Operate in UAE | Yes | Yes (within scope) | No |

| Trade licence | Required | Required | Not applicable |

| Regulatory eligibility | Strong | Depends on the Free Zone | None |

| Banking access | Moderate | Strong | Limited |

Benefits and Trade-Offs of Free Zone Structures

Free zone entities allow founders to retain full ownership and repatriate profits and capital without restriction. Incorporation processes are typically faster and more digitised than on the mainland, and corporate documentation is generally conducted in English. Free zone companies are not currently subject to Emiratisation quotas, which provides flexibility in early-stage hiring.

From a tax perspective, free zone companies may benefit from exemptions for qualifying income, subject to increasingly detailed eligibility criteria and economic substance requirements. These benefits must be assessed carefully in light of the UAE’s corporate tax regime.

Corporate Governance and Management Requirements

Most UAE companies, whether mainland or free zone, require at least one shareholder, one director, and one manager. These roles may be held by the same individual, subject to the rules of the relevant authority.

Shareholders are the legal owners of the company. Their primary role is to contribute capital, hold equity, and exercise ultimate control over the company’s strategic direction through reserved matters such as amendments to constitutional documents, appointment and removal of directors, approval of major transactions, and changes to share capital.

In the UAE, shareholders may be individuals or corporate entities, subject to disclosure of ultimate beneficial ownership. While shareholders are generally insulated from day-to-day liability, this protection is not absolute. In cases involving fraud, misrepresentation, or regulatory breaches, authorities may look beyond the corporate veil, particularly where shareholders exercise de facto control over operations.

Directors are responsible for the overall management and oversight of the company. Their duties extend beyond strategy and commercial decision-making and include ensuring that the company complies with applicable laws, licensing conditions, and regulatory requirements.

In crypto-related businesses, directors are expected to understand the nature of the underlying activities, including token mechanics, custody arrangements, and compliance frameworks. UAE regulators and banks increasingly assess directors on a “fit and proper” basis, examining their experience, reputation, and ability to supervise higher-risk activities. Directors may face personal civil or criminal liability for failures in governance, AML controls, or regulatory compliance, particularly where negligence or wilful misconduct is involved.

Managers are responsible for the day-to-day operations of the company and act as the primary interface with licensing authorities, regulators, banks, and other government bodies. In many UAE jurisdictions, the manager is the individual whose name appears on the trade licence and who is authorised to bind the company in routine operational matters.

Managers are typically required to be natural persons and, in practice, need to hold a valid UAE residence visa and Emirates ID, particularly for banking and compliance purposes.

In mainland UAE and in certain free zones, the titles “director” and “manager” are sometimes used interchangeably, which can create confusion regarding legal responsibility. Founders should therefore ensure that roles, authorities, and reporting lines are clearly defined in constitutional documents and internal policies.

Proper governance structuring at the outset not only reduces regulatory and banking risk but also provides clarity and protection for founders as the business scales.

Request a strategy call to set up the right Web3 corporate structure →

From Idea to Entity in 30 Days:

A Founder-Ready Crypto Company Formation Timeline

One of the biggest myths we see about setting up a crypto company in the UAE is that it takes months of bureaucracy and endless back-and-forth with authorities. In reality, a well-structured crypto company can be formed within days, if the groundwork is done properly and decisions are made in the right order.

This section breaks down what a realistic 30-day setup looks like for crypto and Web3 founders in 2026, separating what actually matters from what usually causes delays.

Days 1–14: Regulatory Assessment and Structural Design

The first 14 days should be all about answering the questions that regulators, banks, and future investors will ask. During this phase, the business model is examined in substance, not in marketing language. This includes analysing how the product works, how users interact with it, whether the company touches client assets, facilitates transactions, sets prices, or earns fees, and whether any of these functions fall within the definition of regulated Virtual Asset Service Provider activities. The outcome is a clear determination of whether the company can operate under a standard trade licence or whether regulatory VASP authorisation is required.

At the same time, founders assess jurisdictional fit.

The choice between mainland UAE, an economic free zone, or a financial free zone is not cosmetic. It affects banking access, compliance burden, hiring, investor perception, and the feasibility of future licensing. A structure that is acceptable for a software-only Web3 platform may be entirely unsuitable for a tokenisation or brokerage model.

By the end of the first 14 days, a well-prepared founder should have a defensible regulatory position, a clear understanding of licensing triggers, and a structure that aligns with both the current product and its anticipated evolution.

The purpose of this phase is to clearly avoid the following:

- Accidental engagement in regulated virtual asset activities without the required authorisation

- Exposure to significant regulatory fines, including penalties of up to AED 1 billion

- Disgorgement of profits earned from activities later deemed unauthorised

- Personal liability for founders, directors, and managers arising from misclassification or governance failures

- Incorporating a company that is unbankable, non-operational, or structurally incompatible with the product

- Forced restructuring or re-incorporation after launch, resulting in lost time, cost, and credibility

Days 14–17: Jurisdiction Lock-In and Name Reservation

Once the structure is agreed, the next step is committing to the jurisdiction and reserving the company name. This is usually straightforward but still requires care, particularly for crypto businesses.

Certain words, token references, or financial terminology can trigger additional scrutiny or outright rejection if used incorrectly. At this stage, founders also finalise shareholding arrangements, identify directors and managers, and prepare initial KYC documentation.

By the end of this phase, founders should have:

- a confirmed jurisdiction and authority,

- a reserved company name,

- clarity on shareholding and management roles,

- a clean, regulator- and bank-friendly activity description.

Days 18–20: Incorporation and Licence Issuance

This is the phase founders usually expect to be the hardest, but when the groundwork is done correctly, it is often the smoothest.

During this period, incorporation documents are filed, constitutional documents are issued, and the trade licence is granted. For free zone entities, much of this process is now digital, allowing incorporation without physical presence in many cases.

Importantly, this licence confirms only that the company legally exists. It does not authorise regulated crypto activity unless a separate regulatory approval is obtained.

By the end of this stage, founders should have:

- an incorporated legal entity,

- a valid trade licence,

- issued constitutional documents,

- initial establishment cards and immigration files opened (where applicable).

Days 21–30: Emirates IDs, Team Contracts, Banking, and Operational Readiness

Once the company has been structured correctly and the regulatory positioning is clear, the final phase focuses on turning the legal entity into a functioning business. This is the point at which founders and key team members can apply for UAE residence visas and Emirates IDs, formalise employment and contractor arrangements, and begin the banking application process.

At this stage, employment agreements are put in place to reflect actual roles and responsibilities, governance structures are activated, and internal operational processes are prepared. Banking applications are supported by coherent corporate documentation, aligned activity descriptions, and a defensible compliance posture, significantly increasing the likelihood of approval.

A disciplined 30-day setup process routinely saves founders hundreds of thousands in remediation costs and 12 months or more of operational delay later on, by avoiding failed banking attempts, forced restructurings, regulatory misalignment, and credibility issues with counterparties.

Downloadable “Crypto Company Setup Checklist (UAE, 2026)” for Founders

To make this process easier to execute, many founders prefer a practical checklist they can follow internally or with advisors. A step-by-step checklist covering strategy, jurisdiction selection, incorporation, banking readiness, and early compliance.

This checklist is designed to help founders track progress, align internal teams, and avoid the most common early-stage mistakes.

The Role of Specialists Crypto Lawyers in the UAE

Crypto businesses are not traditional startups. They operate at the intersection of corporate law, financial and virtual assets regulations, AML/CFT, data protection, payments, custody, and technology law. In the UAE, these areas are overseen by 5 different Regulators and multiple Authorities, each applying its own legal and risk framework. As a result, a structure that is legally valid for incorporation can still fail in practice if it misclassifies activities, triggers unintended regulatory exposure, or cannot pass banking due diligence.

General corporate advisors typically focus on incorporation mechanics and standard documentation. Crypto businesses, however, require activity-based legal analysis:

- how the product functions in reality,

- where value flows,

- who controls assets, and

- whether the company is facilitating transactions or merely providing technology.

UAE regulators and banks assess substance over form, meaning operational reality matters more than labels or marketing language.

Specialist crypto lawyers bridge the gap between founders, regulators, and banks.

- founders focus on speed and product;

- regulators focus on definitions and risk;

- banks focus on governance, controls, and exposure.

When these perspectives are not aligned at the structuring stage, companies often become incorporated but remain non-operational, and even worse face substantial regulatory penalties.

The role of specialist crypto counsel is therefore strategic, not administrative. Proper legal structuring preserves regulatory optionality, supports bankability, and reduces personal exposure for founders, directors, and managers, particularly in areas such as AML failures, unauthorised regulated activity, and misleading token or marketing narratives.

How NeosLegal Supports Crypto Founders

NeosLegal is a UAE-based, crypto-native law firm advising founders, investors, and institutions since 2016. We have structured over 300 crypto and Web3 projects in the UAE and internationally, working directly with founders at early, growth, and institutional stages.

Our support focuses on creating structures that actually work in practice. This includes selecting the appropriate jurisdiction, assessing licensing triggers, incorporating companies across mainland and free zones, and aligning activity descriptions, governance, and documentation with the real business model.

As crypto businesses evolve, we provide ongoing regulatory advisory to support expansion, licensing transitions, token launches, partnerships, and institutional engagement. The goal is to avoid repeated restructurings and to give founders a legal foundation that supports growth rather than constrains it.

If you want a second set of eyes on your structure before you incorporate, NeosLegal can sanity-check your jurisdiction, licensing triggers, and setup plan and highlight the fastest compliant path forward.

Frequently Asked Questions

1. Do I need a licence to start a crypto company in the UAE?

Yes.

Every business in the UAE must obtain a valid trade licence to operate legally. If your activities involve regulated virtual asset services, such as operating an exchange, providing custody, brokerage, issuance, or facilitating trades, you will also require regulatory approval from the relevant authority.

A trade licence alone does not authorise regulated crypto activities.

2. What is the difference between a trade licence and a VASP regulatory licence?

A trade licence confirms that your company is legally incorporated and permitted to conduct general commercial activities.

A VASP regulatory licence governs specific crypto activities that may be carried out and is required when your business model falls within regulated virtual asset services.

Regulatory licences impose capital, compliance, governance, and reporting obligations that do not apply to standard trade licences.

3. Is it better to set up a crypto company in a UAE free zone or on the mainland?

For most crypto and Web3 founders, free zones are the preferred option. They offer 100% foreign ownership, English-language documentation, streamlined incorporation, and fewer operational constraints.

Mainland entities may be suitable in specific cases but can trigger Emiratisation requirements, Arabic-language documentation, and more complex administrative processes.

4. Can I operate a crypto business in the UAE without regulatory approval?

Only if your activities clearly fall outside regulated virtual asset services.

Regulators assess substance over form, meaning they look at what your business actually does, not how it is described on paper.

Operating regulated crypto activities without approval can result in severe penalties, including significant fines of up to AED 1 billion, disgorgement of profits, and personal liability for founders and managers.

5. Are offshore companies suitable for crypto businesses in the UAE?

Offshore entities cannot conduct business within the UAE and are generally used only for holding assets, token issuance, or intellectual property.

For most crypto founders, modern structures such as ADGM Special Purpose Vehicles (SPVs) are more suitable, as they offer better governance frameworks, stronger regulatory credibility, and improved access to banking.

6. What ongoing compliance obligations apply after setting up a crypto company?

After incorporation, companies must comply with ongoing obligations including:

- annual licence renewals,

- Ultimate Beneficial Owner (UBO) filings,

- corporate tax registration,

- audited financial statements (where applicable),

- AML and compliance requirements,

- data protection obligations, and

- proper salary payments through the Wages Protection System (WPS).

Failure to comply can lead to fines, suspension, or blacklisting.

7. Why should crypto founders work with specialist crypto lawyers in the UAE?

Crypto businesses operate across overlapping legal, regulatory, and technological frameworks.

Specialist crypto lawyers understand how regulators classify activities, how banks assess risk, and how token structures interact with UAE law.

Working with experienced crypto counsel helps founders avoid misclassification, secure banking, preserve regulatory flexibility, and protect themselves from enforcement risk.

This guide reflects UAE crypto regulatory practice as applied by VARA, ADGM, CMA and DFSA as of 2026 and is based on real licensing, enforcement, and banking outcomes observed in over 300 structured projects.

About the Author

Irina Heaver is the UAE Crypto Lawyer and Founder of NeosLegal. She has structured over 300 crypto and Web3 projects and advised governments and regulators on crypto asset frameworks.

Legal Disclaimer: This article provides general information about crypto regulation and government liaison strategies. It is not legal advice and should not be relied upon as such. Regulatory requirements vary by jurisdiction and specific business circumstances. Always consult qualified legal counsel in your target jurisdiction before making market entry or compliance decisions.